SERVICES

Cloud Accounting

Our experience with diverse clients and industries allows us to offer time-saving solutions and innovative tech software and apps. Whether it’s accelerating customer payments or streamlining card payment reconciliation, we have the right solutions for you. We embrace the fast-paced changes of the tech industry and eagerly learn from its abundance of offerings.

Is your business ready for Making Tax Digital?

Making Tax Digital (MTD) is a complete Government overhaul of the UK tax system, requiring businesses and individuals to switch to an entirely digital system for the storage and submission of tax data.

We’ll take the time to understand your business requirements and recommend the right software for your accounting needs.

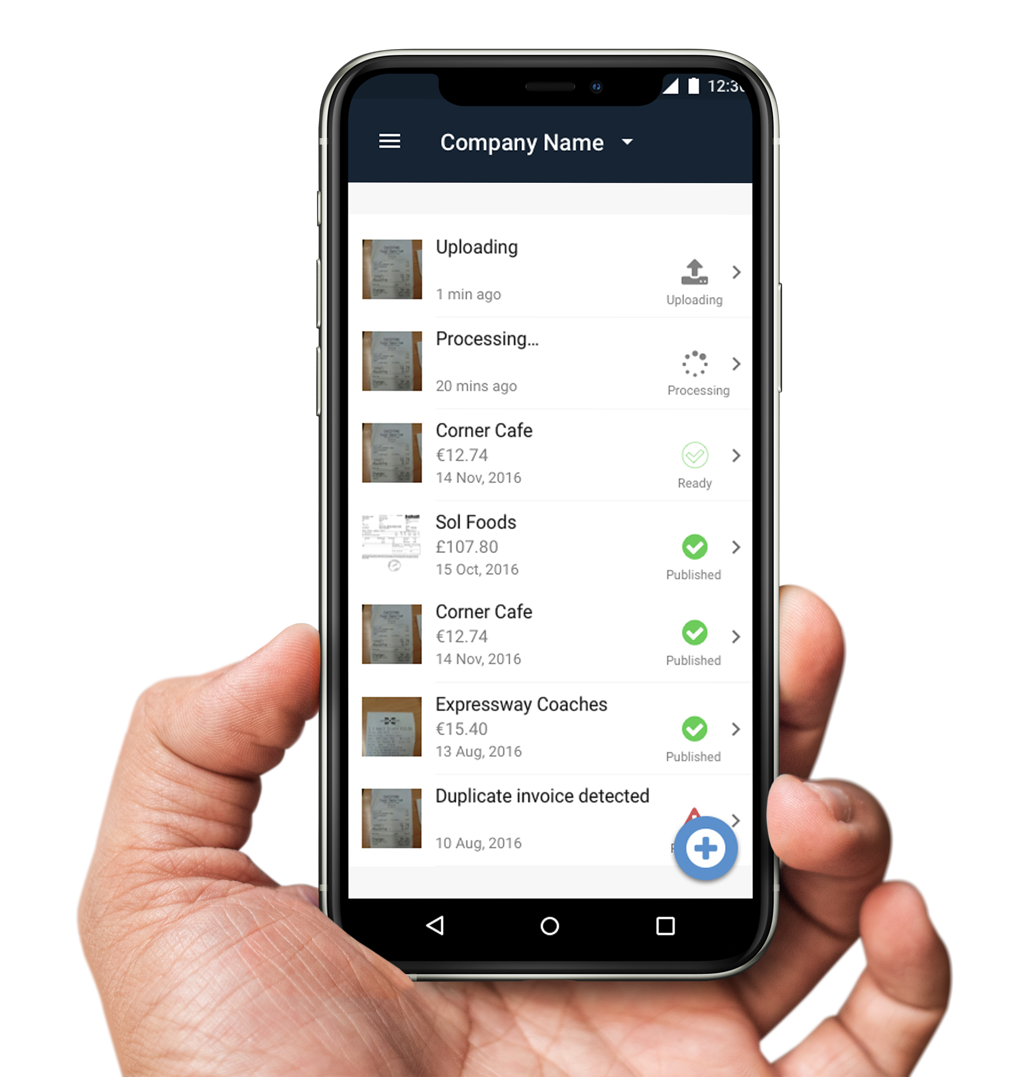

Cloud accounting software gives fantastic insight on how you are performing. But, in order to provide you with valuable data and performance results, it has to be kept up to date. We want to ensure our clients have this information and so we want it to be simple to use.

Put simply, there is a 3 step model to follow, as shown below. We can then provide you with regular reports on how you are performing which will allow you to tweak how your business is operating in real-time.

Invoice

Capture

Reconcile

“If someone asks me what cloud accounting is, I would say, put simply, it’s a better way to run your business.”

—Lorna Hourigan